As a follow-up to our Top EHS Trends for 2022 webinar, RegScan is taking a closer look at some of the activities shaping the EHS compliance and sustainability space this year. This blog post will focus on a top trend for 2022: the continuing focus on ESG.

ESG is very much a topic of interest for companies across the globe. RegScan’s team hears about it from clients and prospects as part of the strategic objectives for their business and EHS professionals play a key role.

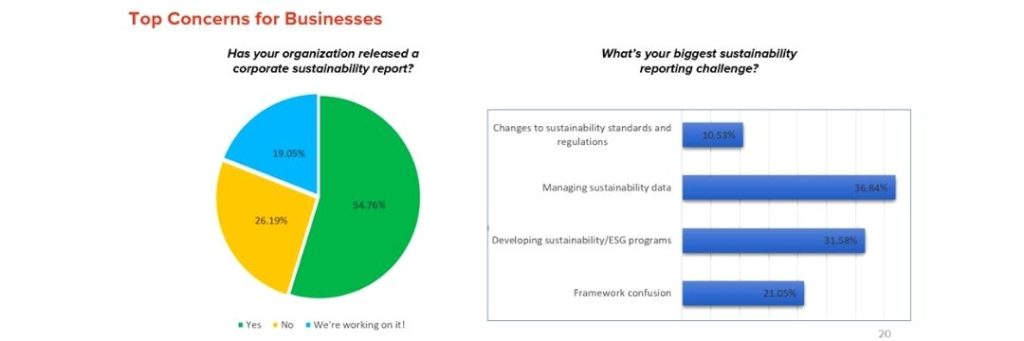

In September 2021, as part of our webinar The Job of ESG: How Companies are Managing the Work, we polled attendees on two questions: Whether their organization had released a Corporate Sustainability Report (or CSR)? And what was their biggest sustainability reporting challenge?

A few key takeaways:

- Focus on Producing a CSR: Companies are serious about producing a CSR with more than half having already completed one and another 20% working on their first. It’s increasingly become the norm for most large companies: an expectation of investors and other key stakeholders.

- Managing ESG Data: While there are challenges around using the right standards/frameworks, managing ESG data is the biggest challenge. The best ways to collect data and then figuring out the right way to share it with stakeholders remains a top objective for businesses.

While companies have largely been taking the lead on their own, the Securities & Exchange Commission (SEC) announced a game-changer in early 2022: proposed rules that would require businesses to disclose information related to climate-related risks. The proposed rules would also require a registrant to disclose information about its direct greenhouse gas emissions (known as Scope 1) and indirect emissions from purchased electricity or other forms of energy (known as Scope 2). The SEC released a Fact Sheet on the proposed rules. The comment period remains open, and observers believe legal challenges to any final rules are likely.

The SEC originally published guidance on climate-related disclosures back in 2010. The push to require businesses to disclose information on climate-related risks is the first meaningful guidance since then. Sustainability objectives have continued to move to the forefront of business goals in recent years and companies have been expecting guidance for some time, a nod to investors’ interest in climate-related reporting and disclosures.

Stay tuned.